Legacy Financial Advisors:

Dedicated to being your retirement guide

Since 2004, we have worked with thousands of clients in the Greenville and Anderson communities in South Carolina, as well as various other states across the US, to uncover their financial and retirement goals and craft tailored recommendations to help them strive for success.

At Legacy Financial Advisors, we don’t just point you down the path to retirement, we help you reach your full stride. Take the next step with us and book your appointment today.

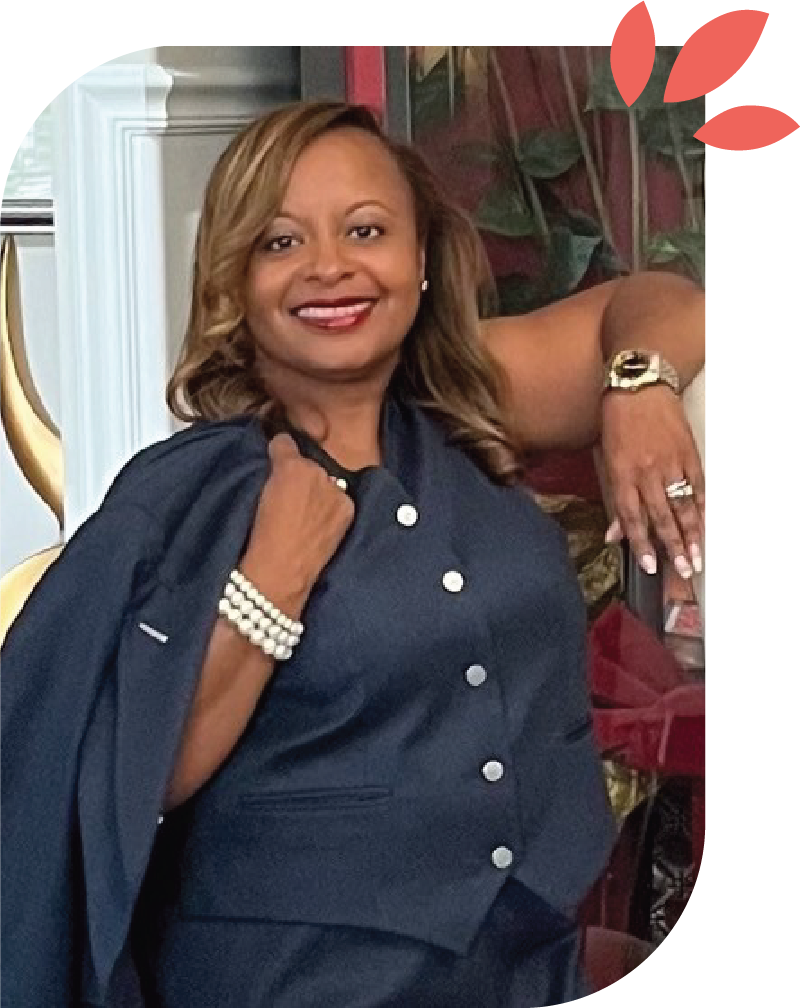

Felicia Littlejohn

I’m Felicia Littlejohn and I’m here to helping you uncover your financial priorities, plan for the future, and live your best life.

Principal & CEO

M. Felicia Douglas-Littlejohn is licensed insurance agent and holds the National Social Security Advisor (NSSA®) certification. She offers Retirement Income Strategies and Social Security maximization using insurance and annuity products. She is the Principal and CEO of Legacy Financial Advisors, and has been serving clients and retirees for 20-plus years, successfully establishing herself as a resource in South Carolina, Georgia, and North Carolina.

Felicia services private and public institutions, business owners, pre-retirees, retirees, and other individuals by delivering client-centered and priority-driven financial strategies at her offices located in the Greenville and Anderson areas.

As a testament to her unwavering commitment to her career and community, she has received several commendations from various organizations for her civic and philanthropic efforts for promoting economic development and financial empowerment.

Awards, recognitions, media-mentions and credentials:

- Received the National “Award of Excellence 2023 Top Advisor”.

- Recognized as a 2020 Women Business Leader in Wealth Management and Top Women in Business by SC Business Magazine.

- Recognized as a first woman and woman-of-color member of the Million Dollar Roundtable.

- Featured in Forbes Advisors Advocates and other magazines with emphasis on Financial and Retirement Planning.

- Recognized as a Black History Maker by 107.3 JAMZ in 2013.

- Nominated for the 2010 Athena Award by the Business Women in Action Association.

- Partnered with New York Life where she was recognized for setting a record-high in paid accounts in the entire Greenville General Office.

- Featured on talk radio shows on 94.5 “The Answer,” Rejoice 96.9 FM and 106.3 WORD.

- Featured in television financial segments on WYFF Channel 4, WLOS News 13 and WHNS FOX 21.

- Earned a bachelor’s degree in Business Management from the University of South Carolina, Spartanburg.

- Serves on many advisory boards in Greenville and is a member of several organizations including the United Way Advisory Board and Campaign Cabinet Member.

- Serves as an officer and member of Epsilon Beta Omega Chapter of Alpha Kappa Alpha Sorority.

New Paragraph

New Paragraph

Resources and insight to support your retirement journey

Download our brochures and checklists to help you plan for your retirement goals.

5 Essential Strategies to Help Ensure Financial Success in Retirement

Download Now

Maximize Your Retirement: 5 Smart Money Moves For Your Old 401(k)

Download Now

Maximize Your Social Security Benefits: Separating Fact From Fiction

Download Now

Questions?

We're here to help.

We will get back to you as soon as possible.

Please try again later.

Contact us

1200 Woodruff Road

Building A-3

Greenville, SC 29607

Stop by

Legacy Financial Advisors, LLC, offers insurance and annuity products and services. We do not provide investment, tax or legal advice.

Investment advisory services offered through duly registered individuals on behalf Legacy Financial Advisors, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Legacy Financial Advisors, LLC are unaffiliated entities. Licensed Insurance Professional.

Life insurance and annuity products are not suitable for everyone. They involve fees and charges including possible surrender penalties. Optional riders may involve an additional annual fee. Health care riders are NOT a replacement for long term care insurance. Product and feature availability may vary by state. Life insurance generally requires medical and often financial underwriting. Annuity withdrawals are subject to ordinary income taxes and potentially a 10% IRS penalty before age 59-1/2. Insurance and annuity guarantees are backed by the financial strength and claims-paying ability of the issuing company.

Licensed Insurance Professional. Respond and learn how insurance and annuities may positively impact your retirement. This material has been provided by a licensed insurance professional for informational and educational purposes only and is not endorsed or affiliated with the Social Security Administration or any government agency. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice.

Medicare Advantage Plans are insured or covered by a Medicare Advantage organization with a Medicare contract and/or a Medicare-approved Part D sponsor. Enrollment in the plan depends on the plan’s contract renewal with Medicare. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Availability of benefits and plans varies by carrier and location. Deductibles, copays and coinsurance may apply. Plans purchased after initial enrollment period are subject to eligibility requirements.

We are not affiliated with Medicare or any other government agency. By contacting us, you will be connected with a licensed insurance agent.